Irs Schedule C Instructions 2024 – That could provide a break to some taxpayers on their taxes in 2024. The tax agency on Thursday said it’s adjusting the tax brackets upwards by 5.4%, relying on a formula based on the consumer . The IRS revealed updated federal income tax brackets and standard deductions for the upcoming tax year 2024, affecting returns filed in 2025. The adjustments, unveiled on Thursday, showcase .

Irs Schedule C Instructions 2024

Source : www.acawise.com

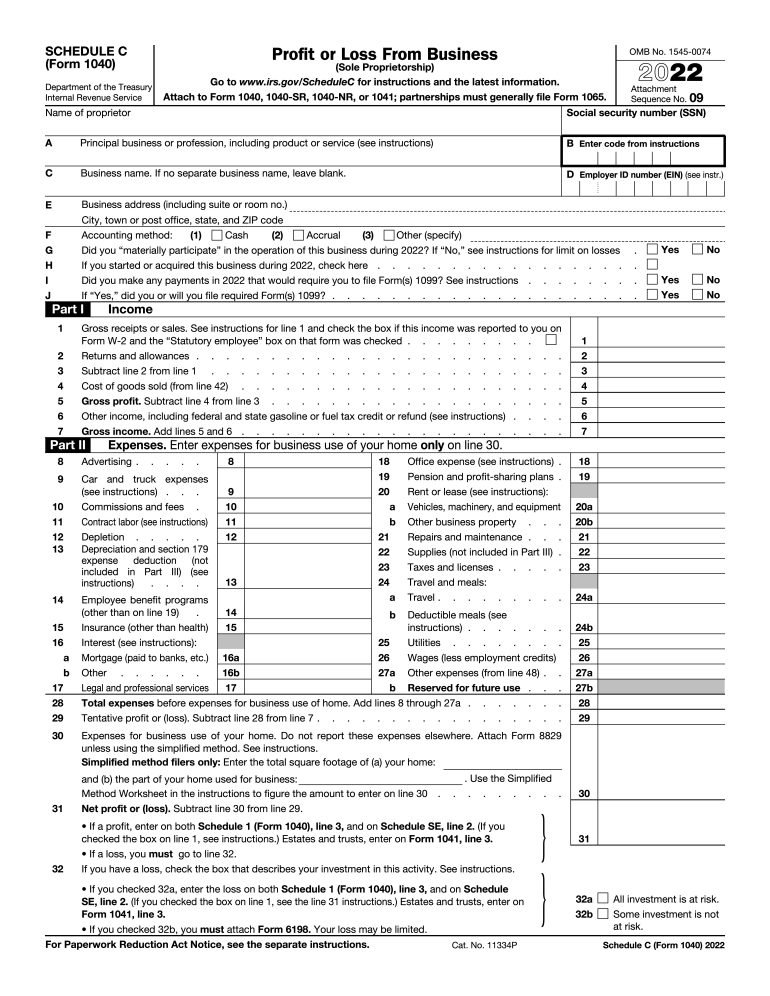

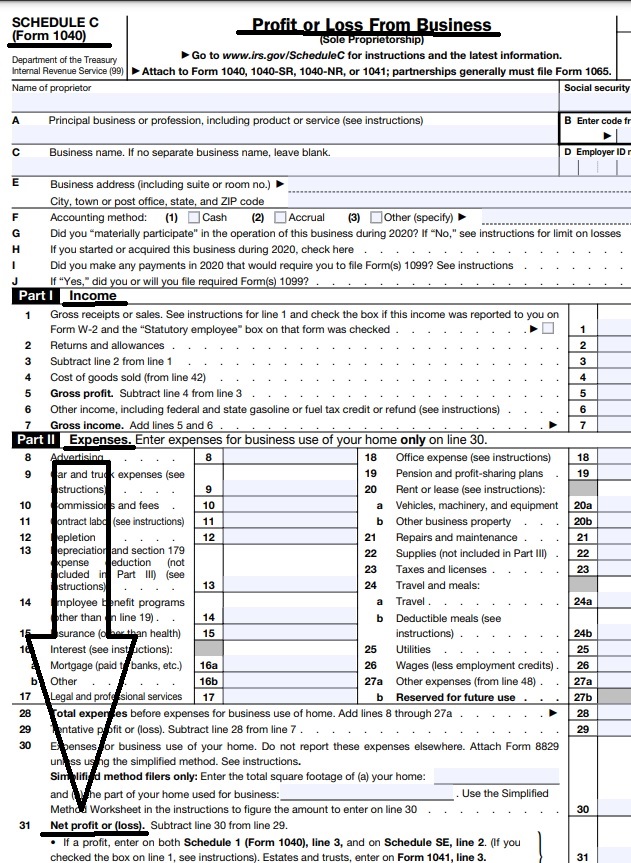

What Is Schedule C (IRS Form 1040) & Who Has to File? NerdWallet

Source : www.nerdwallet.com

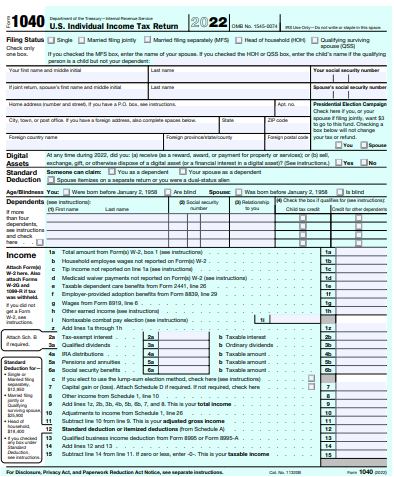

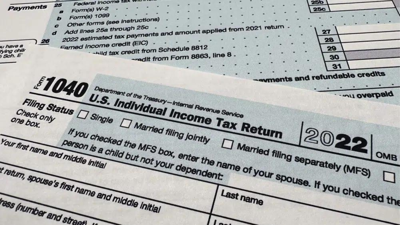

Form 1040 for IRS 2023 2024 ~ What is it? Schedule A B C D

Source : www.incometaxgujarat.org

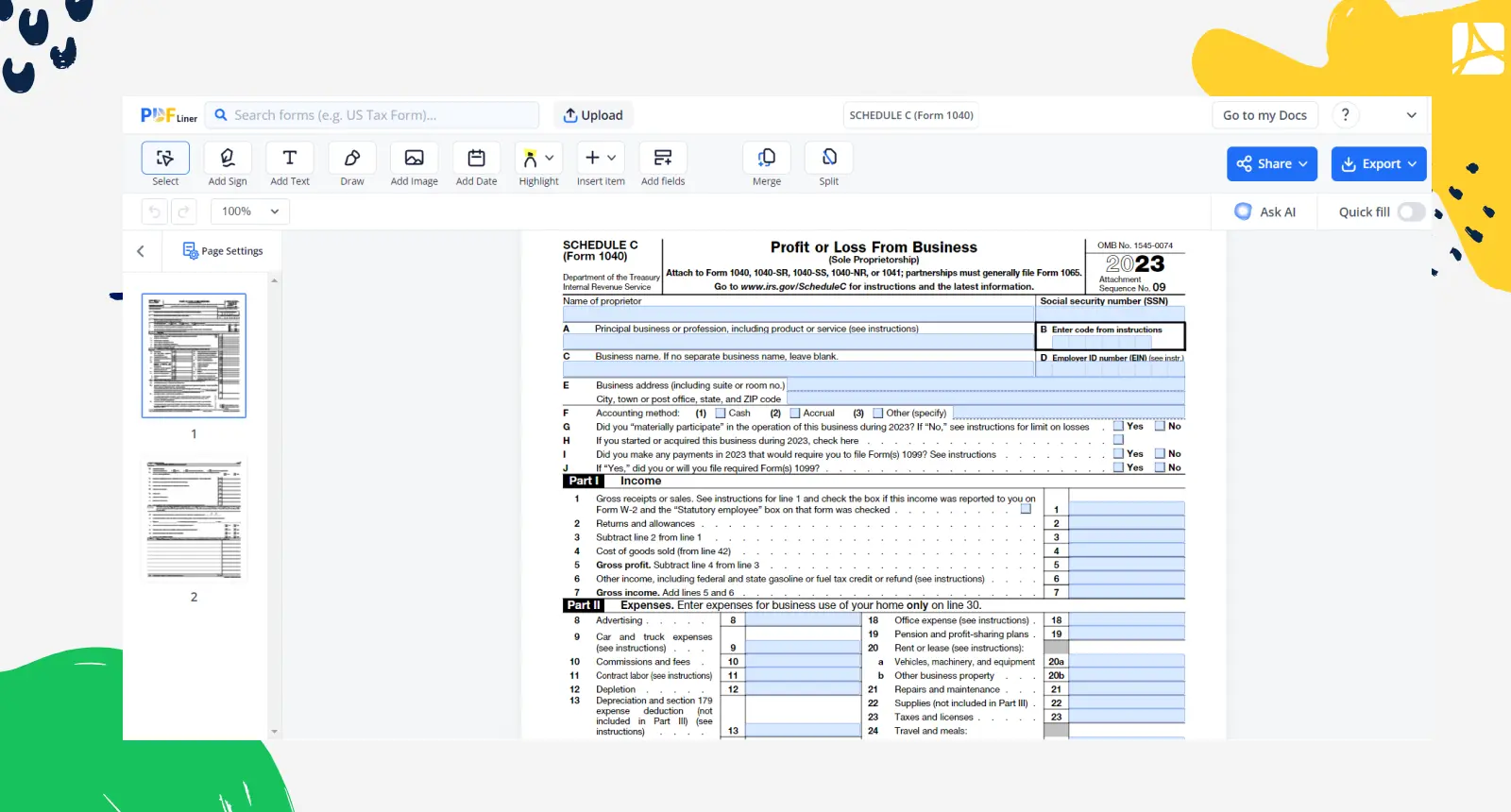

Taxes Schedule C Form 1040 (2023 2024) | PDFliner

Source : pdfliner.com

IRS Schedule C Walkthrough (Profit or Loss from Business) YouTube

Source : m.youtube.com

2024 Tax Brackets: IRS Reveals New Income Thresholds | Money

Source : money.com

Schedule C 1040 line 31 Self employed tax MAGI instructions home

Source : individuals.healthreformquotes.com

Form 1040 for IRS 2023 2024 ~ What is it? Schedule A B C D

Source : www.incometaxgujarat.org

IRS moves forward with free e filing system in pilot program to

Source : www.fox13memphis.com

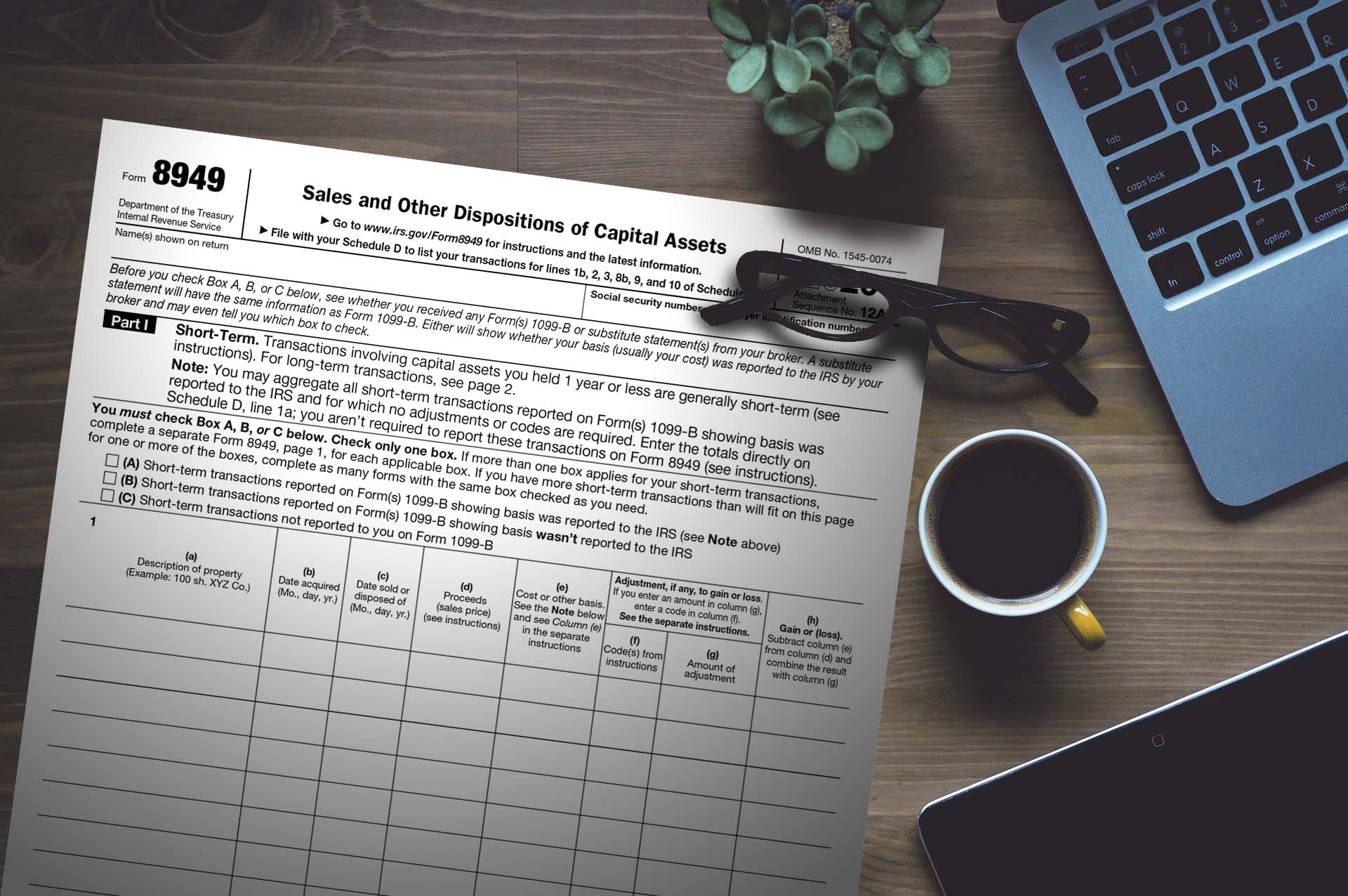

IRS FORM 8949 & SCHEDULE D TradeLog

Source : tradelog.com

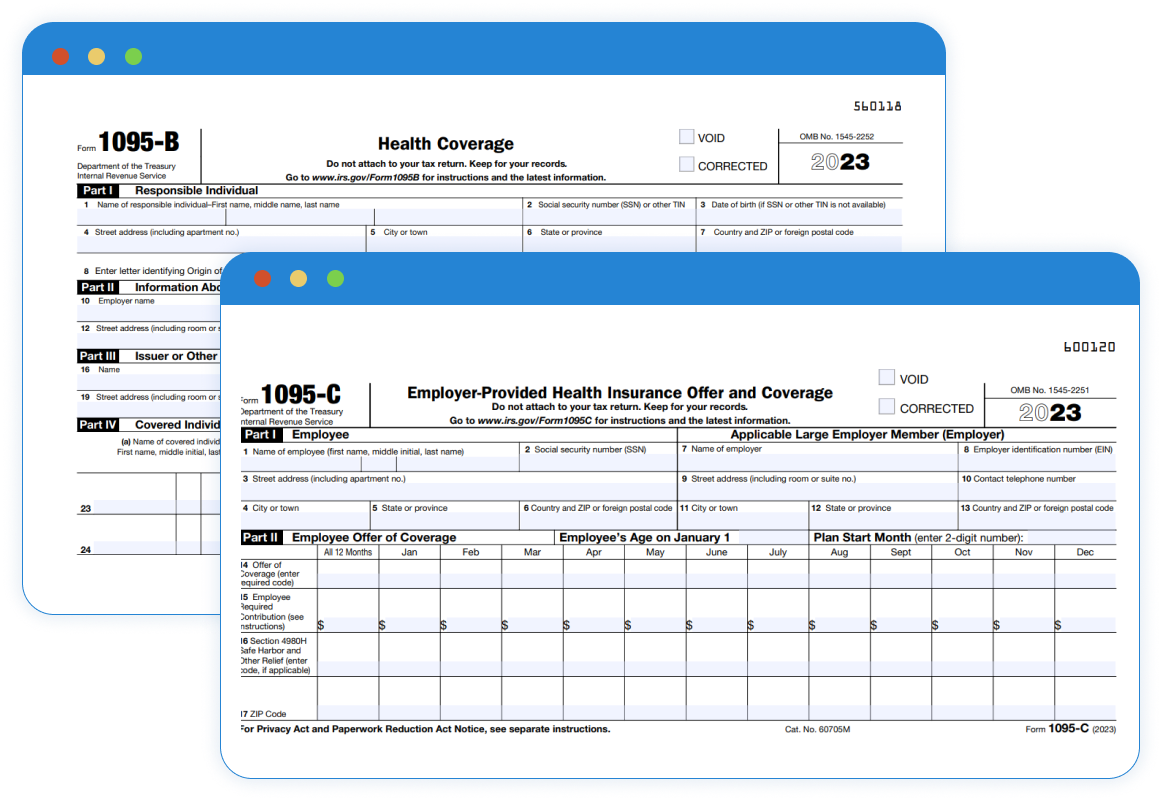

Irs Schedule C Instructions 2024 The IRS Releases Final Version of Form 1095 B & 1095 C for 2023 : The Internal Revenue Service announced inflation adjustments on Thursday for more than 60 tax provisions for tax year 2024. Revenue Procedure 2023-34 sets out the tax year 2024 adjustments, which . In other words, someone with $100,000 in taxable income in 2024 would fall into the 22% bracket, but would owe a tax bill far below $22,000. Get your tax years straight Tax years can get confusing. .