Irs Schedule 1 2024 Instructions – The Internal Revenue Service (IRS) has revealed new income tax rates for the year 2024, with substantial ramifications for taxpayers. This update affects the way individuals and families will be taxed . The Internal Revenue Service announced inflation adjustments on Thursday for more than 60 tax provisions for tax year 2024. Revenue Procedure 2023-34 sets out the tax year 2024 adjustments, which .

Irs Schedule 1 2024 Instructions

Source : www.ez2290.com

What is IRS Form 1040 Schedule 1? TurboTax Tax Tips & Videos

Source : turbotax.intuit.com

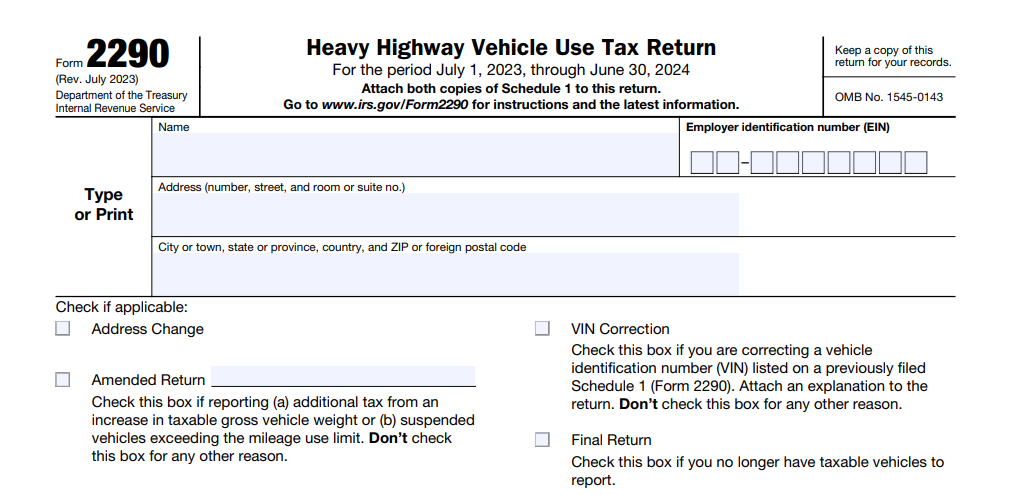

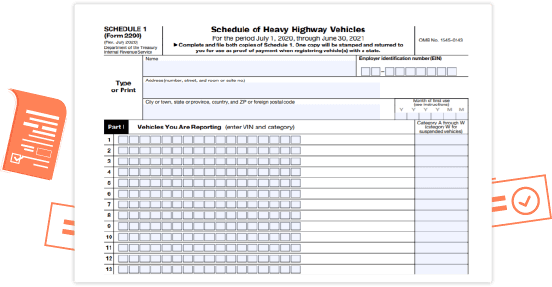

IRS Form 2290 Instructions for Steps to File for 2023 2024 | J. J.

Source : www.2290online.com

2024 Tax Brackets: IRS Reveals New Income Thresholds | Money

Source : money.com

Publication 505 (2023), Tax Withholding and Estimated Tax

Source : www.irs.gov

IRS Form 2290 Filing Instructions, Due Date, & Mailing Address

Source : www.trucklogics.com

Form 1040 for IRS 2023 2024 ~ What is it? Schedule A B C D

Source : www.incometaxgujarat.org

The IRS Releases New 1095 Draft Instructions for 2024

Source : blog.acawise.com

IRS launches paperless processing initiative for correspondence in

Source : newsismybusiness.com

IRS announces new income tax brackets, higher standard deduction

Source : centraloregondaily.com

Irs Schedule 1 2024 Instructions Instructions for IRS Form 2290 | How To File Form 2290 for 2023 2024: Don’t miss out during the 2024 tax season. Register for a NerdWallet When you receive your Schedule K-1 by March, the documentation should share instructions for how to report your shares on . The IRS received balances over $1.4 million,” the IRS indicated that it would use some of the funds from the IRA to examine high-income and high-wealth non-filers in 2024. .