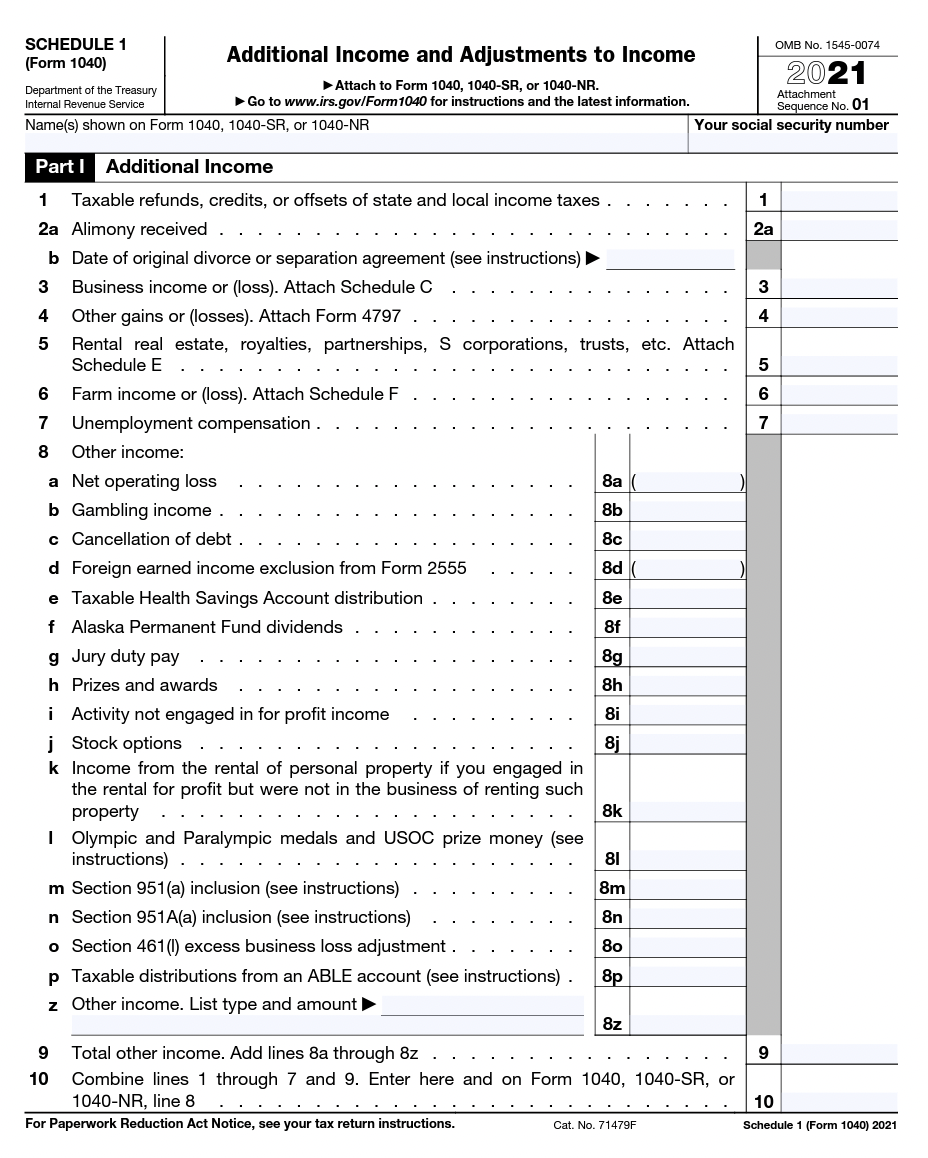

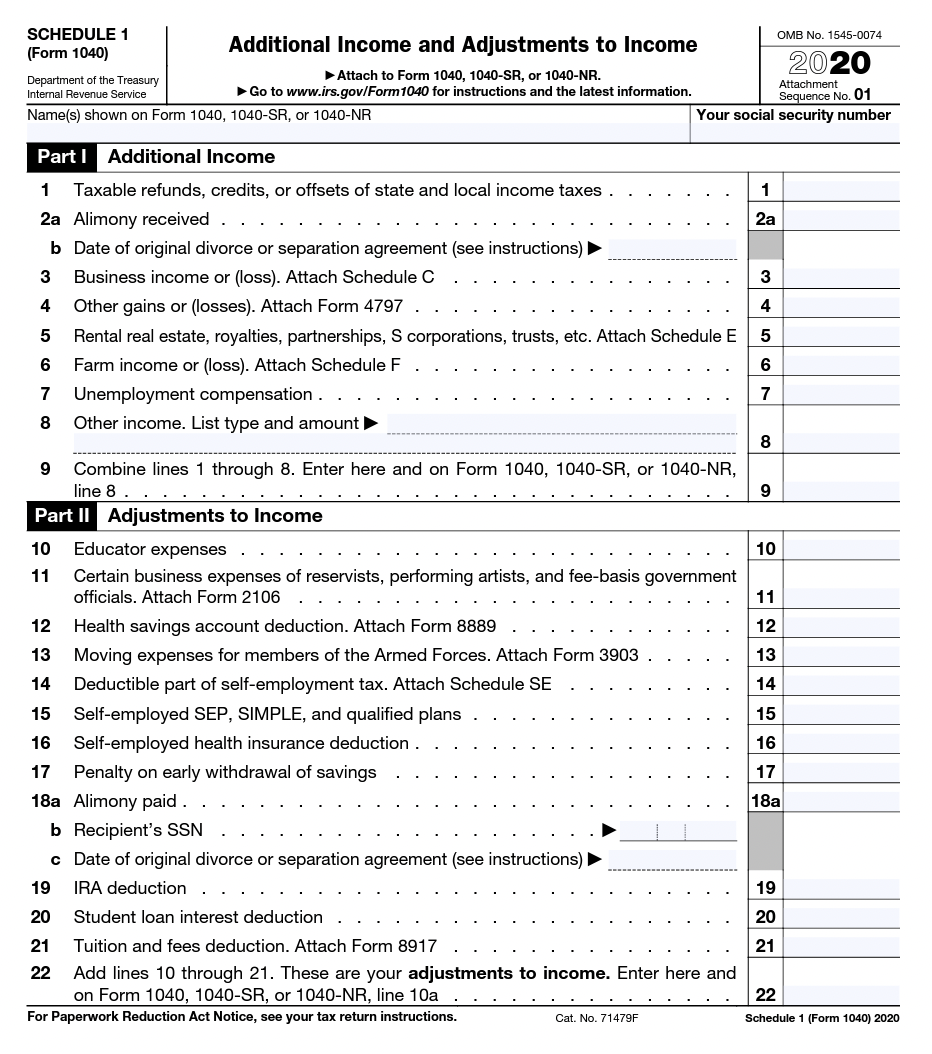

2024 Irs Form 1040 Schedule 1 – Don’t miss out during the 2024 tax season your primary tax return (Form 1040) by the mid-April tax filing deadline or by mid-October with an extension. Partners and shareholders should remember . The IRS has adjusted federal income tax bracket ranges for the 2024 tax year to account for inflation. Here’s what you need to know. .

2024 Irs Form 1040 Schedule 1

Source : turbotax.intuit.com

Publication 505 (2023), Tax Withholding and Estimated Tax

Source : www.irs.gov

Most commonly requested tax forms | Tuition | ASU

Source : tuition.asu.edu

IRS Schedule 1 walkthrough (Additional Income & Adjustments to

Source : m.youtube.com

Most commonly requested tax forms | Tuition | ASU

Source : tuition.asu.edu

Reporting Super Bowl and other gambling winnings on IRS Schedule 1

Source : www.dontmesswithtaxes.com

Most commonly requested tax forms | Tuition | ASU

Source : tuition.asu.edu

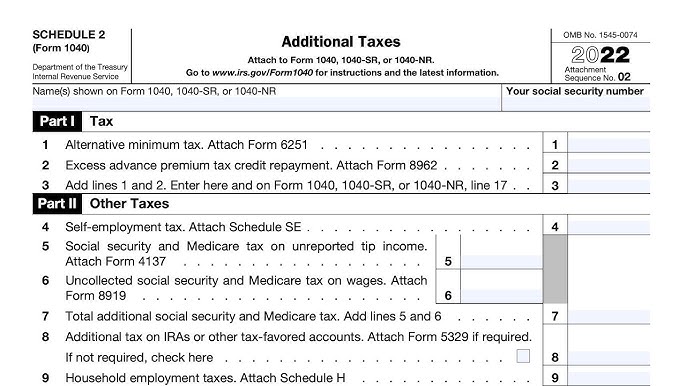

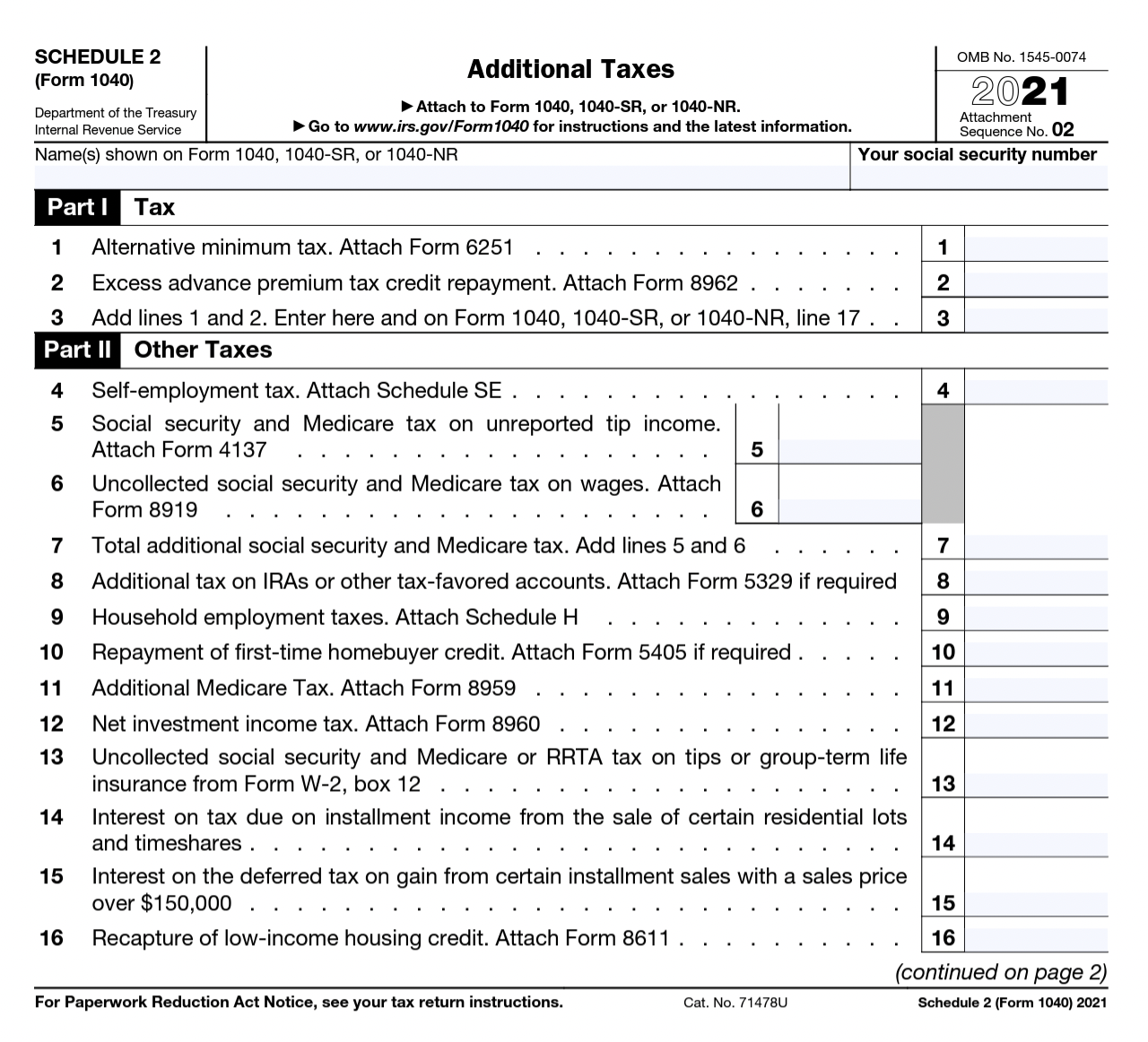

Tax Transcript Decoder: Comparison of 2021 Tax Return and Tax

Source : www.nasfaa.org

Most commonly requested tax forms | Tuition | ASU

Source : tuition.asu.edu

Form 1040 for IRS 2023 2024 ~ What is it? Schedule A B C D

Source : www.incometaxgujarat.org

2024 Irs Form 1040 Schedule 1 What is IRS Form 1040 Schedule 1? TurboTax Tax Tips & Videos: Although the date for filing your tax return for 2024 is a long way off, smart taxpayers will start thinking about that return far in advance. Proper tax planning takes time, so it’s actually wise to . The IRS has announced the annual inflation adjustments for the year 2024, including tax rate schedules, tax tables and cost-of-living adjustments. .